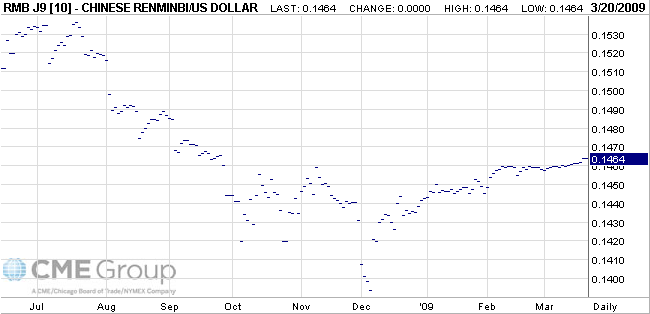

China seems to have fulfilled its promise of a stable currency, given that the Yuan/Dollar exchange rate is one of the few bastions of stability in forex markets. One Dollar trades for approximately 6.83 CNY, about the same as it did last summer. Futures prices, meanwhile, reflect a mean expectation that one year from now, the exchange rate will dip only slightly, to 6.86 CNY/USD. [The inverse is depicted in the chart below].

China seems to have fulfilled its promise of a stable currency, given that the Yuan/Dollar exchange rate is one of the few bastions of stability in forex markets. One Dollar trades for approximately 6.83 CNY, about the same as it did last summer. Futures prices, meanwhile, reflect a mean expectation that one year from now, the exchange rate will dip only slightly, to 6.86 CNY/USD. [The inverse is depicted in the chart below].

In fact, there is even evidence that China is fighting market forces by trying to prop up the value of the Yuan. “‘ If this were a market-determined exchange rate, it would now be weakening, because the overall balance of payments looks to be in deficit, but it is not weakening,’ said [one economist]. ‘The implication is that authorities must be selling their dollar reserves in order to stabilise the USD-CNY exchange rate.’ ” Of course, it’s difficult to determine for sure, since the decline in China’s forex reserves that constitutes the basis for this claim could also have been caused by paper-losses on depreciating investments.

Within China, there is a core group of academics that continues to insist that China should depreciate its currency in response to deteriorating economic conditions. After all, China’s trade “surplus narrowed in February to $4.8 billion from about $40 billion in each of the previous three months, and in all likelihood will fall for the first time in five years in 2009.” Meanwhile, economists estimate that GDP growth could slow to 6%, a far cry from the 13% chalked up in 2007, and well below the government’s goal of 8%.

Some Chinese analysts also take issue with the notion of a ’stable’ currency. ” ‘The stability we expect is not only stability against the USD, but against all currencies,’ said MoC researcher Li Jian. ‘What is stability? Now the RMB is stable against the USD, but is appreciating against the euro, Australian dollar and the yen, so RMB’s exchange rates against these currencies are not stable.’ ” This is an important distinction, since China’s trade rivals are mostly nearby Asian countries- not the US. “Since July, the yuan is up 33% against the Korean won and up 12% against the Singapore dollar, for example. This has made Chinese exports relatively less competitive while spurring more imports and thereby providing somewhat of a boost to other economies.”

hmmmmmmmmmmmmm

ReplyDelete